The landowner must be able to establish that the land is used for a bona fide agricultural purpose. According to Section 193.461(3)(b), the term 'bona fide agricultural purposes' means good faith commercial agricultural use of the land. The Florida Administrative Code defines "good faith commercial agricultural use" as: "The pursuit of an agricultural activity for a reasonable profit or at least upon a reasonable expectation of meeting investment cost and realizing a reasonable profit."

Florida Statute 193.461 Agricultural lands; classification and assessment

Section 3, Paragraph (b) Subject to the restrictions specified in this section, only lands that are used primarily for bona fide agricultural purposes shall be classified agricultural. The term "bona fide agricultural purposes" means good faith commercial agricultural use of the land.

In determining whether the use of the land for agricultural purposes is bona fide, the following factors may be taken into consideration:

- The length of time the land has been so used.

- Whether the use has been continuous.

- The purchase price paid.

- Size, as it relates to specific agricultural use, but a minimum acreage may not be required for agricultural assessment.

- Whether an indicated effort has been made to care sufficiently and adequately for the land in accordance with accepted commercial agricultural practices, including, without limitation, fertilizing, liming, tilling, mowing, reforesting, and other accepted agricultural practices.

- Whether the land is under lease and, if so, the effective length, terms, and conditions of the lease.

- Such other factors as may become applicable.

- LENGTH OF TIME:

- Was the agricultural operation in effect on January 1st of the year you are applying for?

- Was the property being applied for historically used for agriculture?

- CONTINUOUS USE:

- How long has the property been used for agriculture?

- Has there been a lapse in the agriculture use on the property?

- PURCHASE PRICE PAID:

- Florida Administrative Code Rule 12-D-5.001(2) states good faith commercial agricultural use of the property is defined as "The pursuit of an agricultural activity for a reasonable profit or at least upon a reasonable expectation of meeting investment cost and realizing a reasonable profit. The profit or reasonable expectation thereof must be viewed from the standpoint of the fee owner and measured in light of their investment." Therefore, the expectation of profit requires consideration of the relationship between the price paid for the land and the economic feasibility/return of the recognized agricultural operation.

- SIZE:

- While there is not a minimum or maximum acreage that may qualify for the agricultural classification, the burden is on the property owner to establish that the requested acreage is reasonable for the recognized agricultural operation regarding economic feasibility and has an expectation of profit.

- The following sizes are not a requirement but rather a "guide" that represent typical minimum thresholds for economic feasibility.

| Pasture |

Optimum Acres* |

| 10 Cows breeding age females or equivalent animal units |

>= 20 |

| 30 Goats, sheep or hogs breeding age females or equivalent units |

>= 20 |

Horses:

Breeding – 3 reg. brood mares & 1 stallion in production annually

Boarding* – Minimum of 3 horses. Must submit boarding contracts. |

>= 20 |

| * If the application is for a boarding operation, the horses cannot belong to the property owner to qualify. |

| Hay production |

>= 20 |

| Sod |

>= 20 |

| Row Crop |

Optimum Acres* |

| Corn, grain sorghum, soy beans, rye, wheat, oats |

>= 20 |

| Vegetables, peanuts, tobacco, sunflower |

>= 10 |

| Timber |

Optimum Acres* |

| Planted pines – planting rate 700/ac |

>= 10 |

| Christmas trees – planting rate 1100/ac |

>= 5 |

| Tree farm-field nursery – planting rate 1100/ac |

>= 5 |

| Natural pines/mixed |

>= 20 |

*TOTAL UNLESS USED IN CONJUNCTION WITH OTHER PARCELS

| Specialty Crops |

Optimum Acres* |

| Grapes |

>= 5 |

| Strawberries, blueberries, blackberries |

>= 2 |

| Citrus, apples, peaches, pecans, pears, persimmons |

>= 10 |

| Bees |

>= 5 |

| Additional "specialty crops/commodities" will be considered on an individual basis. |

- STEWARDSHIP

- Timber

- Generally, a timber/forest management plan is prepared a local professional forester or a person with adequate knowledge of timber management practices (local county or private forester) and not the landowner themselves. The timber/forest management plan is helpful to the agriculture classification process, and the quality and completeness of plan goes a long way in providing useful documentation that the landowner indeed meets the requirements necessary to qualify for the agriculture classification. A timber/forest management plan should be implemented, and a copy of the plan should be provided with your application.

- Merchantability of the timber will be considered as well as other sufficient management plan implementation such as fire lanes, under brushing, reforesting, etc.

- For ongoing Timber operations, if the property has been clear-cut, the owner should notify this office at the time of harvest. Acreage must be replanted by the end of the third year.

- Smaller tracts used for Christmas tree production will be considered as nursery land.

- Pasture

- Property must be fenced.

- A visible effort must be made to maintain and care sufficiently and adequately for this type of land, i.e.: fertilizing, liming, tilling, mowing, etc.

- Row Crops

- "Row Crops" is used in reference to those agricultural products referred to as vegetables.

- Production of crops for own use does not qualify parcel of land for agricultural classification, i.e.: garden.

- Crop must be marketed commercially, and any sales receipts should be provided with the application.

- Nursery

- Nurseries should have a state agricultural certificate and occupational license and proof of that should be provided with your application.

- Only areas actively used for the nursery and service operation shall be classified.

- Types of Nurseries may include but are not limited to: In ground (ornamental), above ground (in pots), tree nursery (Christmas trees).

- Apiary/Bees

- The property owner must provide documentation identifying the number of colonies involved in the “commercial” operation. The State of Florida requires a minimum of 100+ registered hives/colonies to be considered a commercial operation. 40 or less registered hives/colonies are typically considered “backyard” beekeepers and are not considered bona fide commercial agricultural operations. Additionally, the property owner must provide the location of the colonies if the colonies are not located on the subject parcel on January 1. The documentation should indicate when the bees are expected to be located on the subject parcel and the justification for the bees not being on the parcel on January 1.

- The bee operation’s business plan may accompany an application and must clearly define the apiary endeavor being conducted on the property for which agricultural classification is being requested.

- Beekeepers must be registered with the Florida Department of Agriculture and Consumer Services. If inspections are required for the operation, that documentation must be included with your application. The beekeeper’s state-issued certificate should be submitted to our office annually, showing the commercial operation is still functioning.

- If the property is leased, the lessee’s state registration and contact information must be provided with the application.

- Specialty Crops (including but not limited to)

- Pecan – Trees up to 15 yrs old – Minimum of 25 trees per acre at 40' spacing.

Trees over 15 yrs old – Minimum of 12 trees per acre at 60' spacing

- All other "specialty crops/commodities" will be reviewed on an individual basis.

- LEASES

- When a property is leased for agricultural purposes, the same criteria are used in granting or denying the application. It is the responsibility of the owner of the property to ensure that the lessee is complying with all laws that govern the agricultural classification, and a copy of the lease must accompany the application. The lease must be in effect on or before January 1 for the year of the application. The lease must also clearly indicate the real property for which the classification is requested. The lease may cover multiple parcels of land if this office can clearly identify the parcel involved. In addition, contact information for the lessee should be provided to determine they have a bona fide commercial operation.

- What are the terms, effective length and conditions of the lease and are the lease terms economically compatible with a bona fide commercial agricultural operation?

- If the property is leased, there must still be an expectation of profit, thus the provided lease must indicate a monetary amount being paid by the lessee. A lease stating $0 or "Free Rent" for the term of the lease cannot be considered.

- ACTUAL USE

- The actual use of the property on January 1st of the year being applied for will be considered, not the expected use or future use.

- There should be no deed and/or zoning restrictions that would prohibit commercial agricultural use.

- If a site plan or plat for lots has been approved by a government agency, the property must have been in active agricultural use on the 1st of January of the previous year, as well as the current year, or the agricultural classification is subject to denial.

- Hunting or leasing for hunting, in and of itself, is not regarded as an agricultural operation

- The following is a brief list of some of the information that will help us with the classified use determination. This is not a required list nor a complete list, however these items are helpful in allowing us to understand your operation and how it qualifies for the requested classification.

- Business plan. The operation’s business plan may accompany an application and must clearly define the endeavor being conducted on the property for which agricultural classification is being requested.

- Invoices, Inventory lists, bills of sale etc. These items document the transactions and assets of the business and assist us in verifying bona fide operations.

- Best Management Practices (BMP). A BMP may be provided to support the classification request.

- Financial. Income and expense receipts related to the agricultural operations for the most recent year of operation may be submitted. For example:

- Sales/Income Receipts

- Boarding contacts, stud contracts, sales receipts for offspring (horses/livestock)

- Operating Expense Receipts

- IRS Form Schedule "T", (Profit and loss for Timber operation).

- IRS Form Schedule "F", (Profit and loss for Farming operation).

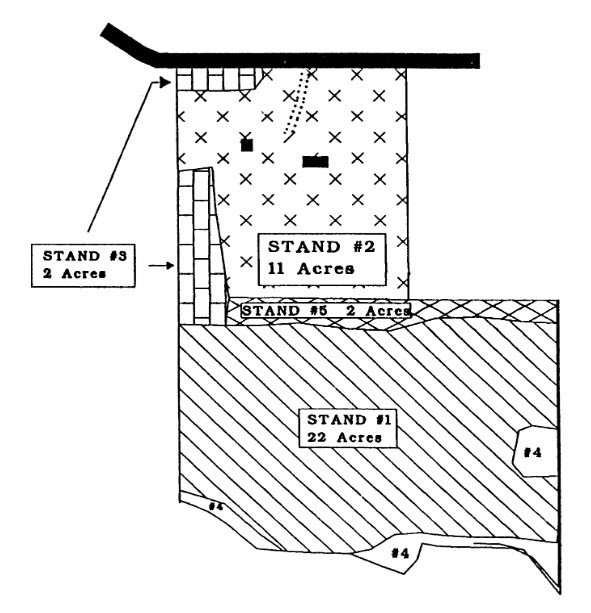

- Provide a site plan or plot of agricultural acreage use, see example below:

*NOTE: These guidelines are provided as a resource to help explain some of the variables seen in commercial operations which we consider for the agricultural classification. Each application will be reviewed individually on its own merits. If the property appraiser denies the landowner's application for an agricultural classification, then the landowner may appeal the decision to the value adjustment board ("VAB") pursuant to Section 193.461(2), Florida Statutes.