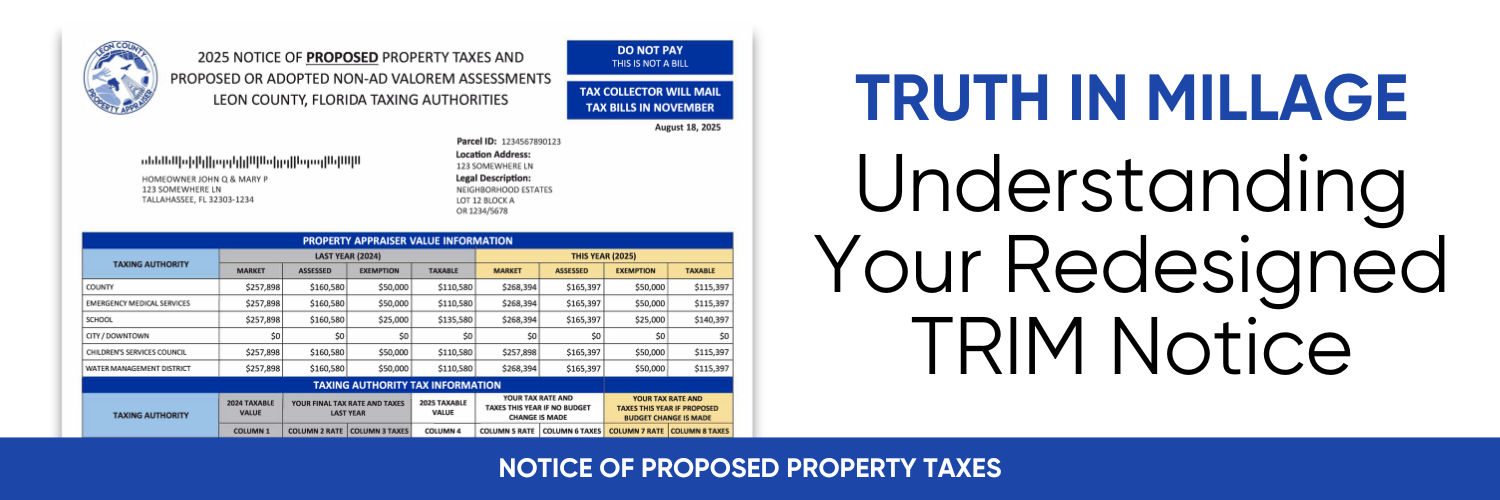

Beginning in August 2025, Leon County property owners will receive a newly redesigned Notice of Proposed Property Taxes–commonly called the TRIM (“Truth in Millage”) notice. This refreshed format is part of our ongoing commitment to transparency, clarity, and service excellence.

What's New

- Property Value Information Front and Center: Your Market, Assessed, and Taxable Values are now prominently displayed at the top of the front page for quick reference.

- Color-Coded Layout: We’ve added color blocks to highlight key sections—making it easier to read and understand the notice at a glance.

- Public Hearing Details on the Back: Information about budget hearings for each taxing authority has been moved to the reverse side to streamline the front page.

- More Helpful Explanations: We've expanded the back page with simplified descriptions of exemptions, assessment reductions, and other important terms.

- QR Code for Quick Access: Scan the included QR code to learn more about your TRIM notice and research available exemptions that may help you save on future taxes.

- Guidance for New Property Owners: New homeowners will find a section explaining why their tax amounts may differ from the prior year.

- Easier Appeal Instructions: Contact information and petition instructions are clearly presented, helping you request assistance if needed.

Have questions? Refer to the Frequently Asked Questions below or call us at (850) 606-6200.

About the 2025 TRIM Notice Redesign

Q: Why did the TRIM notice get redesigned?

A: The new design improves clarity and usability. It prioritizes the information most important to property owners—such as market value, assessed value, and exemptions—and uses color coding and improved layout to make the notice easier to understand at a glance.

Q: What are the most noticeable changes in the new format?

A: Key updates include:

- Property value information moved to the top of the front page

- Color-coded sections for improved readability

- Public hearing information relocated to the back

- Expanded explanations of key terms

- A new section for recent buyers

- QR code for online tools and FAQs

Q: Has the way my property taxes are estimated changed?

A: No. This redesign only affects the presentation of your tax notice. It does not change how values are assessed or how property taxes are estimated.

Understanding the TRIM Notice

Q: What is the TRIM notice?

A: TRIM stands for "Truth in Millage." This notice is not a bill–it’s a summary of your property’s proposed values, tax rates, and estimated taxes based on budget proposals from your local taxing authorities.

Q: When will I receive the TRIM notice?

A: TRIM notices will be mailed on August 18 to all property owners in Leon County.

Q: What are “Market Value,” "Assessed Value," and "Taxable Value"?

A:

- Market Value is the estimated value of your property on January 1 based on local real estate market data.

- Assessed Value reflects your property's value after assessment limitations like Save Our Homes or agricultural classifications are applied.

- Taxable Value is the assessed value minus exemptions. It’s the value used to calculate your taxes.

Q: What are "Exemptions" and "Assessment Reductions"?

A: These are savings applied to your property value based on eligibility:

- Exemptions (like Homestead, Veteran, or Limited Income Senior exemptions) directly reduce your property taxes.

- Assessment Reductions (like Save Our Homes or agricultural classification) limit how much your assessed value can increase each year.

Q: What if I think my market value is too high or my exemption is missing?

A: Contact the Property Appraiser’s Office as soon as possible. You can reach us at (850) 606-6200. To help direct your call efficiently, please use one of the following extension options:

- For residential property values, press 3

- For commercial property values, press 5

- For questions about property tax exemptions, press 1

- For business personal property accounts, press 4

Q: What are “Non-Ad Valorem Assessments”?

A: These are charges for services like solid waste, stormwater, or fire protection. They are listed on your TRIM notice and included on your tax bill, but they are not based on property value.

Q: Where can I learn more about public hearings or proposed tax rate changes?

A: Public hearing information is listed on the back of the TRIM notice. You can also contact the taxing authorities directly for more details.

Q: I bought my home recently—why are my property taxes so much higher than the previous owner’s?

A: Property tax benefits like exemptions and the Save Our Homes assessment cap do not transfer. Upon sale, the assessed value resets to market value, which may result in a higher tax bill. This is explained in the “New Owners” section of the notice.