TALLAHASSEE – Leon County Property Appraiser Akin Akinyemi, PhD, RA, CFA, CMS, has submitted the preliminary 2025 tax roll to the Florida Department of Revenue and local taxing authorities. As of January 1, 2025, Leon County’s overall market values rose nearly 5.4% from 2024, with taxable property values up nearly 7.8%. For properties with a homestead exemption, assessed values will not increase by more than 3% over last year’s value, in accordance with Florida law.

“Property values in Leon County are still rising, but at a more sustainable pace,” said Akinyemi. “This year’s 5.4% increase is a step down from the 7.3% growth seen last year and aligns more closely with the typical 3% to 5% annual appreciation.” He noted that while housing inventory is increasing statewide, it still lags behind demand. “Until supply catches up,” he said, “property values will likely continue to rise—though at a slower rate.”

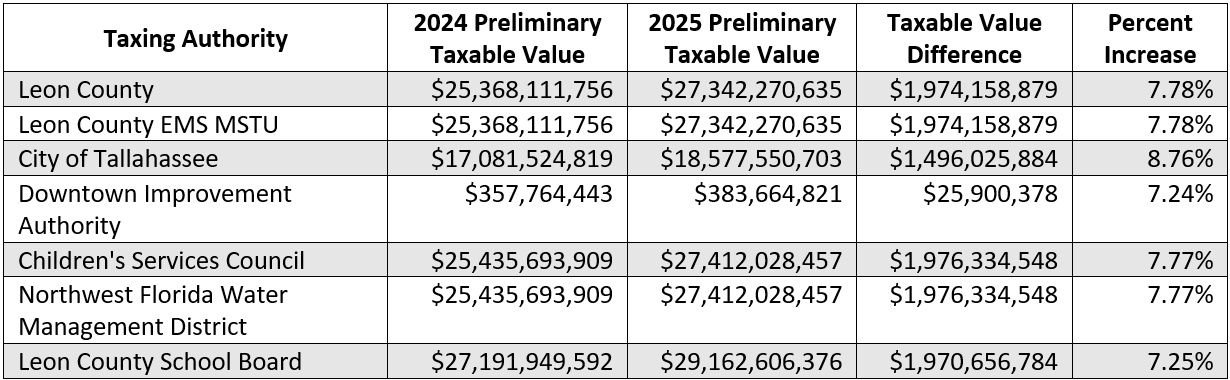

Local taxing authorities, including Leon County, the City of Tallahassee, and Leon County Schools, use these preliminary values to develop their upcoming budgets and set proposed millage rates. In August, property owners will receive a Notice of Proposed Property Taxes and Non-Ad Valorem Assessments, commonly known as a TRIM (Truth in Millage) Notice. This notice will include their property’s assessed value, proposed tax rates, and details about upcoming public budget hearings.